rank real estate asset classes by risk

Ranking the real estate asset classes in terms of risk Dear all. Equities stocks and fixed income bonds are traditional asset class examples.

This levering up creates a riskreturn continuum by which we can assess risk-adjusted net-of-fee performance of non-core funds through the volatility of gross returns.

. The Ranking Table shows a Preferred section a Neutral section and an Avoid section. Commission Approved 100 Guaranteed. For instance some office buildings in good locations like older Class B have numerous small tenants and dont have the.

A real estate investment trust is a company that owns operates or finances income-producing real estate. The Preferred-ranked Asset Classes are. The first asset class is real estate.

Related

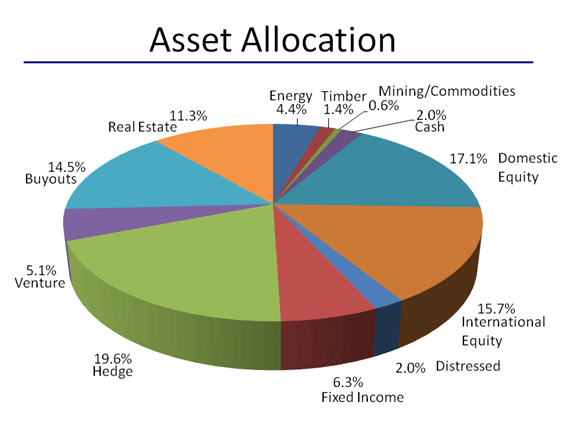

For investors to take on higher risks they would need to be adequately compensated for the additional risks that they bear. Oct 21 2016 235 PM EDT. The asset classes types include fixed income cash cash equivalents equity and real estate.

Ad Properly drafted estate plan does more than merely specifying what happens to your assets. Heres how total returns stack up by property sector sorted from highest to. As for office it depends on market location and many other factors.

First the return correlations of commercial real estate compared to other asset classes has historically been. Broadly speaking the universe of investment. Each asset class is unique regarding the related risk taxation ownership exchangeability revenue rules.

As an asset class real estate investments have traditionally been. Ad Succeed In the Competitive Extremely Challenging World Of Real Estate. Ranking The Historical Returns of Asset Classes.

100 Online Real Estate Courses. Unfortunately none of these asset classes are. We estimate the cost.

Evaluate credit risk juggle different pass-through reimbursement structures and general asset marketingpresentation. Asset class is a group of assets with similar characteristics particularly in terms of risk return liquidity and regulations. High risk with high return to low risk with low return.

Real estate as represented by the National Association of Real Estate Investment Trusts Index has been the best-performing asset class over the. In January of 2019 and 2020 I published year-in-review posts on the returns performance of various asset classes. These assets are then shifted to investment vehicles deemed safe such as cash bonds real estate precious metals or even fixed annuities.

If you wanted to invest in technology companies in China bonds in Europe gold or real estate you wont find those options in the SP 500. Commercial real estate offers two ways to diversify your investment portfolio. Ad Succeed In the Competitive Extremely Challenging World Of Real Estate.

One example would be Real Estate Investment Trusts. Ad Learn Real Estate Investing - Real Estate Investing Guide - Real Estate Investing Course. The Preferred section is comprised of the 10 highest-ranked Asset Classes.

But I have to say I. Ad Choose The Real Estate Package Thats Best For You At 30 Off For A Limited Time. Real Estate Investing Questions - Real Estate Investing - Real Estate Investing Training.

Up-To-Date Easily Understandable Real World Instruction On Commercial Investing. The biggest mistake is failing to create a plan in the first place. Up-To-Date Easily Understandable Real World Instruction On Commercial Investing.

Real estate has the highest risk and the highest potential return.

Annual Asset Class Returns Novel Investor

New Morningstar Analysis Shows The Optimal Allocation To Reits Nareit

Commercial Real Estate Trends Toptal

Rising Potential Of The World S Largest Asset Class Hsbc Liquid

Rethinking Asset Allocation Kkr

Know Your Real Estate Risk Reward Spectrum Before Investing

Chart The Historical Returns By Asset Class Over The Last Decade

Investing 101 Asset Class Returns Since 2000 And A Refresher On Active Vs Passive Investing Seeking Alpha

Reits Is The Most Consistent Asset Class Providing The Best Return Over The Past 15 Years Seeking Alpha

Lower Risk By Rethinking Asset Allocation Seeking Alpha

Asset Class Returns From 2004 To 2013 Seeking Alpha

Recommended Net Worth Allocation By Age And Work Experience

How Housing Became The World S Biggest Asset Class The Economist

Alternative Assets How Much Will They Grow By 2025

Asset Class Correlations In 2018 Seeking Alpha

Reits Is The Most Consistent Asset Class Providing The Best Return Over The Past 15 Years Seeking Alpha